The U.S. ARM industry remains highly fragmented with approximately 70 percent of market share belonging to the mid-size and smaller size firms.

When we first started focusing on ARM industry over 20 years ago, the largest player in the space was Payco American. Remember Payco? At its peak, Payco generated approximately $150 million a year in revenues and they were the largest. Other large players included FCA International based in Canada with a sizable U.S. presence, Union Corp which housed such agencies as Allied Bond and Transworld Systems to name a few. Two interesting facts: (1) the only company from the top ten list of players that existed from 1996 to 2006 that did not go through an M&A transaction was GC Services. Every other company went through at least one transaction. (2) The top 10 list during that time period did not include any debt buyers.

Due to client conditions, increased regulation and the escalating costs associated with operating ARM companies, we believe the landscape of ARM companies will change profoundly and become significantly more concentrated over the next 3-5 years. We are starting to see the signs already.

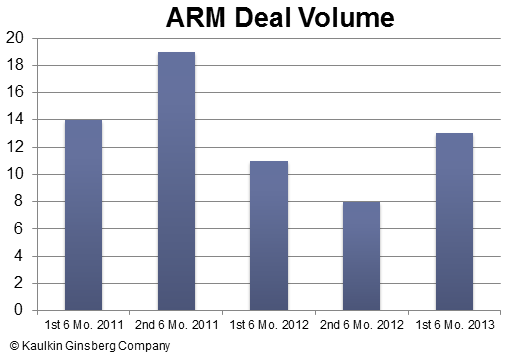

2012 was a year of uncertainty as increasing regulatory scrutiny at the state and federal level, combined with business volume declines in several consumer markets, made it difficult for executives to forecast financial performance. As a result, some buyers decided to take a more wait-and-see mentality and shelf acquisitions, as you can see from this graphic which illustrates the volume of M&A transactions over the last couple years. Other buyers took longer to work through due diligence and some revised their pricing and/or transaction structures to account for potential future transaction risk.

In 2013, buyers and sellers remain cautious but are pursuing more M&A transactions overall. Due diligence continues to take longer to complete compared to pre-recession times, particularly with first time new buyers who are trying to determine how certain trends will impact a seller’s performance. In situations involving underperforming companies, creative deal structuring and risk sharing is almost always being required to satisfy both the buyers’ concerns and the sellers’ needs to close a deal.

We are also seeing significant and newfound interest in purchasing ARM companies focused on the healthcare, government and student loan sectors from non-industry (financial and strategic) and some industry participants which will add to the overall number of transactions completed in the ARM sector.

Rozanne Andersen and I recently hosted a webinar, “An Industry in Transition: Trends and Events Shaping the ARM Industry.” A number of the predictions that I made focused on the changing landscape of mergers and acquisitions, including:

1. Increased regulation will accelerate consolidation within ARM industry. Looking forward over the next 12-24 months, we expect a flurry of vertical transactions as owners of small and mid-size ARM companies seek to sell out or combine forces with larger firms to combat increased operating costs running as stand-alone businesses.

2. On the debt buying front, we will see an outbreak of portfolio sales from some large and many mid-size debt buyers to a handful of LMP debt buyers. However, sellers will have to produce nearly complete data in order for industry buyers to satisfy the needs of the CFPB when purchasing debt portfolios in the secondary market or they will not get full market value for the sale.

3. The intense regulatory environment is creating, for the very first time in the ARM industry, a true barrier-to-entry in the U.S. ARM industry. Fewer ARM companies will be equipped to service needs of the larger grantor due to increased data security and compliance costs.

4. From the dozens of agencies focused on financial services, there will be less than 15 ARM companies left servicing the needs of the largest financial institutions. This includes collection agencies, law firm and debt buyers. Large financial institutions will seek to consolidate their ARM vendor networks even further as they collapse various business lines that were previously managed separately into one focused center. As a result some specialty ARM companies will be forced to consider rapidly expanding or merging with other specialists to successfully maintain existing client engagements.

5. Consolidators will become a part of industry history. The private equity backed roll-ups that took place from 1996 to 2002 were fixated on amassing market share as quickly as possible, regardless of the industry focus, even if the clients serviced by the selling company overlapped significantly. Today’s focus is toward acquisitions with a clear purpose that add select clients or services in a particular market segment.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)