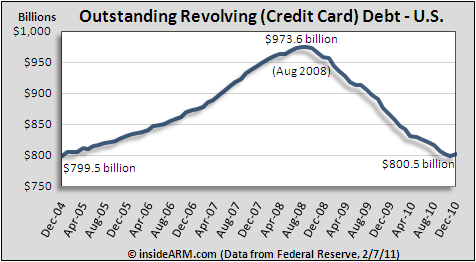

Outstanding credit card debt expanded in December for the first time since summer 2008, according to data released late Monday by the Federal Reserve.

Revolving debt – principally comprised of credit card accounts – grew at a 3.5 percent annual rate in December 2010 to $800.5 billion. December’s gain followed 27 consecutive months of credit card debt declines, beginning the month after Wall Street giant Lehman Brothers collapsed.

The surprise increase may signal that consumers are spending again on credit cards and that issuers are more willing to extend revolving credit to customers. Banks have also worked through an historic backlog of credit card charge-offs that may be winding down.

Overall consumer credit expanded by $6.1 billion, or 3 percent annualized, to $2.41 trillion. Non-revolving debt – primarily auto, student, and personal loans – grew at a 2.8 percent annual rate.

The Fed’s monthly Consumer Credit data release, also called the G.19, does not track debt backed by real estate.

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)